What is an Occupational Pension?

Occupational pensions are organised by employers to provide pensions to one or more employees on retirement, or to their surviving dependants upon the employees’ death. For the most part, large employers in Ireland tend to have occupational pension schemes in place, however, a lot of small to medium sized employers do not. Each occupational pension scheme has its own rules set by the employer. There is absolutely no legal obligation on any employer to offer an occupational pension scheme to their employees, although the government actively encourages employers to do so.

Note: This guide delves into private sector occupational pensions in Ireland. For information in relation to public sector occupational pensions, see here.

Occupational Pensions Vs. Personal Pensions

While an occupational pension is organised by an employer, personal pensions are pensions that are organised privately by people who are self-employed or are employees and who (typically) do not have an occupational pension scheme in place.

However, it is worth noting that you can be part of an occupational pension scheme and you can also arrange a personal pension. But, you cannot contribute to both at the same time with respect to the same employment. It may not be possible to avail of the tax benefits for both pension schemes either. You can however, make a personal pension agreement in relation to earnings from additional or other employment or from self-employment.

Confused? Let’s look at a real life example below.

John is an employee who works as a nutritionist in a large health supplement company (his main day job). He is availing of the company’s occupational pension scheme. However, John also has private clients who come to him for nutritional advice at evenings and weekends where he is self-employed. This business is growing and is a lucrative supplementary income for John and his family. As a result, he wants to set up and contribute to a personal pension scheme with a provider who offers private pensions. John can do this as the pensions are in respect of two different employments, he just may not be able to avail of the tax benefits for both which he may need to clarify with the Revenue.

The Retirement Annuity Contract (Personal Pension)

A personal pension scheme, which you can find out about in more detail here, is more technically known as a Retirement Annuity Contract (RAC). This is an arrangement made by a self-employed person or an employee, (typically someone who is not part of an occupational pension scheme), to provide a pension once retired, or to their surviving dependants upon their death (whichever comes first).

RACs are not regulated by the Pensions Authority of Ireland and the majority of them are effectively insurance policies. A personal pension scheme is a private pension policy that is managed for you by a life insurance company or investment firm that gives pension advice. However, they are governed by tax and financial services legislation.

The PRSA Pension (Personal Retirement Savings Account)

The PRSA became available in Ireland from 2003 and is a form of personal pension that is in place as an alternative to an occupational pension scheme where employers do not want to offer such a scheme.

Legally, an employer in Ireland has to offer access to a minimum of one standard PRSA to employees who are not eligible to join an occupational pension scheme (typically because the employer does not offer it) within six months of employees joining their company. The PRSA is a long term personal retirement account that allows you to save in a flexible manner. For example, if you change your job you can continue to use the same PRSA and you can switch from one PRSA account to another whenever you want at no financial cost to you. PRSAs are particularly important for employees or those who are self-employed who have no provision for a pension. Detailed information on PRSAs is available in ‘A consumer and employers’ guide to PRSAs’ produced by the Pensions Authority of Ireland.

What is an AVC Pension?

AVC stands for Additional Voluntary Contribution. AVCs are the contributions an individual can make to their pension to build up an additional retirement fund. They are effectively a ‘top-up’ option. Upon retirement, an AVC fund can be used to top up a person’s occupational pension benefits, within limits set by the Revenue. They are useful should a person’s occupational pension benefits fall short of the maximum benefits at retirement, or if a person simply wants to boost the value of their pension fund. For further information on AVCs, why a person might consider them and how they work, see here.

Types of Occupational Pensions

Occupational pension schemes can be contributory or non-contributory, funded or unfunded, defined benefit, or defined contribution.

Contributory

Both the employee and the employer pay contributions towards the scheme.

Non-Contributory

The employee does not pay contributions towards the scheme, but the employer does.

Funded

Almost all occupational pension schemes are funded. This means that the contributions are put into a designated fund and the benefits are paid out from that designated fund.

Unfunded

The most notable exception to funded pension schemes is the public service pension arrangement. In this case, there is no designated fund and benefits are paid out of current government funds.

What is a Defined Benefit Pension or Scheme?

A defined benefit pension scheme is one where the benefit entitlement is defined in some way. This can be defined in reference to a person’s earnings, their length of service, an index, or a fixed amount. It is a good option for people who want the reassurance of knowing in advance what their pension will be.* Depending on how you define it, your pension could be half of your final salary, or it could be a specific amount each week.

Something to keep in mind with these types of schemes is that contributions may have to be varied on occasion to ensure that the fund can meet the level of required benefits. Depending on the employer, the scheme may have a provision to top the fund up if it is needed, however employees should look into the details of the scheme with their employer.

*Important Note: Defined benefit pension schemes are not guaranteed. If the scheme’s fund is not sufficient to pay out the benefits and the employer is not able to meet the shortfall, certain benefits may have to be reduced.

What is a Defined Contribution Pension or Scheme?

A defined contribution pension scheme by comparison is where the contributions are fixed by agreement, however the benefits are decided by referencing the value of the contributions paid into the scheme. They are not fixed in advance. So, you do not know what level of pension you will get.

An example of a defined contribution pension scheme looks like this:

• The employer and the employee each contribute 5% of the employee’s earnings to the scheme.

• The total contribution is 10%.

• The 10% is used to buy the benefits at retirement.

• However, it also depends on the investment return achieved, less any fees and charges, in addition to the actual cost of buying the benefits.

What Are the Pension Tax Relief Limits for my Contributions?

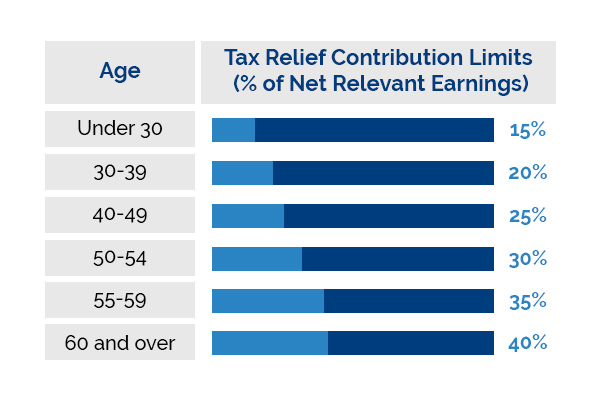

Tax relief on pension contributions for employees who are opted into occupational pension schemes are typically given through their company payroll system. According to The Pensions Authority, the amount of tax relief that is available to you from your pension contributions, is dependent on your age. Tax relief is given at your highest tax rate. No tax relief is available on the Universal Social Charge or PRSI.

There is an annual maximum amount of earnings for which tax relief is available. It is currently €115,000, but it is adjusted occasionally by the Minister for Finance. If you make contributions, but you do not get tax relief on them because you exceed the tax relief limits, it may be possible to apply for tax relief on these contributions in the future.

Exceptions

If you are a professional sports person, or are in a profession where it is standard to retire from that profession at a much earlier age than normal; you may be eligible to avail of tax relief on 30% of your net relevant earnings, regardless of your age. Relief is given at your highest tax rate.

Regulatory Notice

C & E Freeman Ltd trading as The Mortgage Shop, Easy Life Cover, TMS Financial Services is regulated by the Central Bank of Ireland.

Directors: Eamonn Freeman and Catherine Freeman. Company Registration No. 49757