Irish Life has developed a new protection plan based on the cover people and families in Ireland need most – a replacement income for your family if you die before your cover ends, money to cover your bills if you cannot work due to illness or injury and a lump sum for recuperation if you were to suffer from one of the specified illnesses covered under the plan.

We have designed OnePlan Protection to provide you with tailored cover that suits your needs and budget.

What Benefits are available?

OnePlan Protection offers a number of benefits from which you can choose, depending on your needs and personal circumstances.

- Decreasing life cover – we will pay you a lump sum if you or anyone covered on the plan dies. Your chosen life cover amount will reduce each year. This is because the length of time you need that level of replacement income for reduces as you get older. Your financial adviser will discuss this with you.

- Bill cover – to pay your essential monthly bills (mortgage, rent, utility bills) if you cannot work because of an illness or injury.

- Specified illness cover – a lump sum to help you recover without extra financial worries if you suffer from one of the conditions covered under the plan.

- Life cover to protect your family – you can choose level life cover (life cover for an agreed time period) and / or whole-of-life cover (cover which will stay in place until you die).

- Funeral cover – to help your family cover the cost of your funeral and other related expenses.

Remember you can choose any benefit on its own or a combination of the benefits, whichever best suits your needs.

The cost of each individual benefit – and the total cost of all of the benefits you have chosen – will be clearly shown on your plan schedule.

You will only ever pay one plan fee for each plan, it does not matter how many benefits you choose.

You must keep up your payments to stay covered. You cannot cash in your plan. It is not a savings plan.

You must be 18 years or older to buy OnePlan Protection. You can include cover for your partner under OnePlan Protection, if you want.

We will not pay claims in certain circumstances – for example if you have not given us full information about your health, occupation, country of residence, hobbies or pastimes. You will see a summary of these situations in the ‘Guide to making a claim’ section of this booklet on page 22.

Decreasing Life Cover

With this benefit, we will pay a one-off lump sum to your dependants if you die before your cover ends. Your chosen life cover amount will reduce each year. This is because the length of time you need that level of replacement income for reduces as you get older.

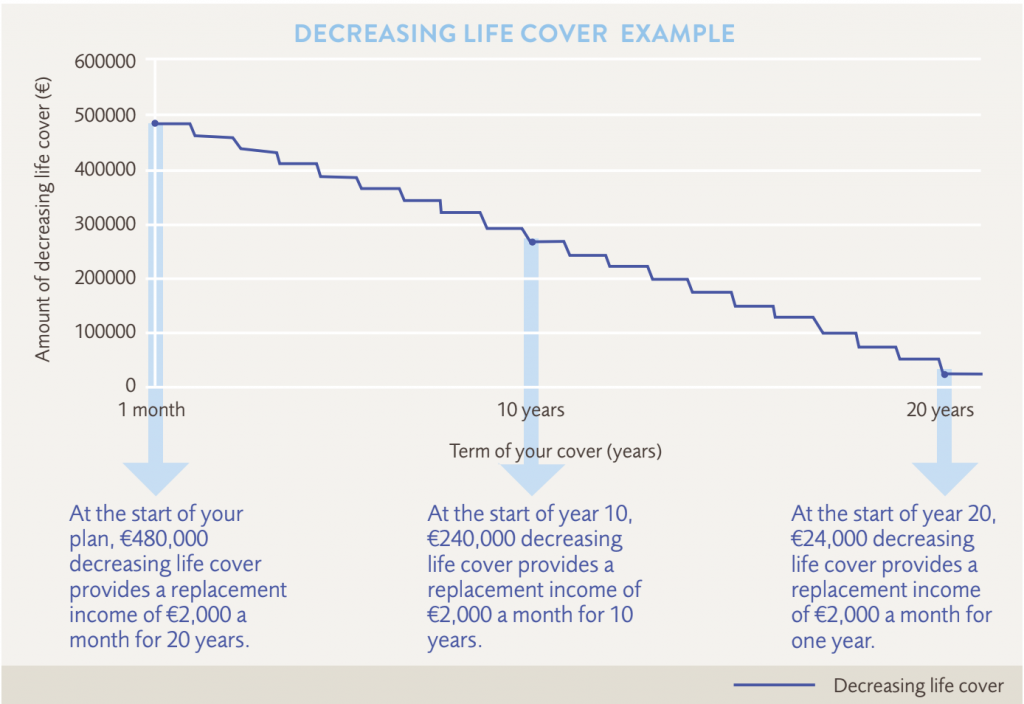

For example, as shown in the graph below, at the start of your plan, €480,000 decreasing life cover provides a replacement income of €2,000 a month for 20 years.

At the start of year 10 of your plan, your decreasing life cover has reduced to €240,000, to provide you with a replacement income of €2,000 a month for 10 years.

Because the life cover amount reduces over time, the lump sum your dependants would receive if you die also reduces over time, so will be less towards the end of the term of your cover than when you first took out your plan.

The graph below shows how decreasing life cover works. Your financial adviser will explain how much cover you need based on your circumstances.

This graph assumes you have taken €480,000 worth of decreasing life cover for a 20-year term and shows how your level of cover reduces over the 20 years.

Benefits of decreasing life cover

- We will pay a lump sum if you or anyone covered for this benefit under the plan dies – this lump sum can be used to replace any income lost.

- Your chosen life cover amount will reduce each year, as the length of time you need that level of replacement income for reduces as you get older. Take a look at the graph on the previous page for some examples of how decreasing life cover works. – At the start of your plan, €480,000 decreasing life cover provides a replacement income of €2,000 a month for 20 years. – At the start of year 10, €240,000 decreasing life cover provides a replacement income of €2,000 a month for 10 years. – At the start of year 20, €24,000 decreasing life cover provides a replacement income of €2,000 a month for one year.

- Your payments stay the same throughout the term of your cover, so you always know how much it will cost you.

- If you choose guaranteed cover again (conversion option) when you take out your plan, you can change your decreasing life cover benefit up to age 75, without having to provide evidence of health. You must do this before the decreasing life cover benefit on your plan has ended. Please see page 20 and your plan terms and conditions for more details.

Applying for decreasing life cover

- You can apply if you are under age 75. The maximum length of time you can be covered for is 40 years or up to age 80, whichever is earlier.

Please see your plan terms and conditions which have full details of this benefit, including any restrictions or exclusions which may apply.