Why do I need Business Protection?

Anyone in business today wouldn’t think twice about insuring their business against loss from fire or theft. However, there are many other circumstances that can have damaging and lasting consequences for your business. Indeed, without the right kind of protection, your business, even your family’s finances, could be in financial ruin.

ASK YOURSELF THE FOLLOWING:

• How would your business survive if one of your key employees or shareholders became seriously ill or died suddenly?

• If your business partner died what would happen to their share of the business?

• How would you feel about a shareholder’s family joining your business if he died suddenly?

• If you died what would happen to your share of the business?

• Are your spouse or children in a position to take your place in the business?

• How will your family survive financially?

If any of the above questions are a cause for concern you may need Business Protection

IT WON’T HAPPEN TO OUR COMPANY!

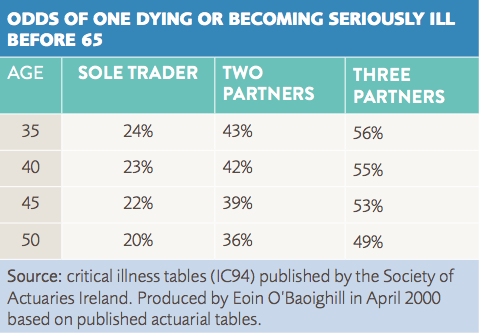

There is very little in life of which we can be absolutely certain, but one fact is guaranteed, we are all going to die… some day. The one unknown, thankfully, for most of us is that we have no idea when this will be. However, the odds of one partner in a 2 or 3 man business dying or becoming seriously ill before retirement are probably a lot higher than you might think.

What's the Solution?

Many problems can arise for a business when a partner or key employee is out of the picture due to death or serious illness. Some of these problems could be alleviated with adequate financial planning to provide the funds to allow options and choices to be made by all parties. Arranging adequate Business Protection Insurance is the only way to ensure that the necessary funds will end up in the right hands at the right time, and in a cost efficient manner, to help ensure the continuity and the survival of the business.

OUR EXPERTISE:

Ensuring the survival of your business, either when you pass it on to your children or in the event of a partner dying, requires careful planning. Your Advisor can assist you with putting together an arrangement to suit your Business Protection needs which will help ensure the continuing success of your business.

• KEYPERSON INSURANCE

This allows a limited company to plan for the potential financial loss that it would suffer on the death or serious illness of a key employee.

• PERSONAL SHAREHOLDER PROTECTION

This allows the shareholders of a limited company to provide funds for the purchase of the share of the deceased shareholder from their personal representatives with the life assurance contract affected by the shareholders personally.

• CORPORATE SHAREHOLDER PROTECTION

This is an arrangement whereby the company agrees with each shareholder to buy back his shares from his personal representatives on death, with the insurance cost being borne by the company. This ensures security for the Company, and peace of mind for the family/dependants of the deceased.

• GIFT OR INHERITANCE TAX PLANNING

This allows you to plan in advance for any tax liability which could arise on the transfer of a business, thus ensuring the business won’t have to be sold off to pay the tax debts. As well as providing advice on the above arrangements, your advisor can assist you and your business with the following services:

• Review of individual circumstances

• Draft Legal Documents